E-file Form 941 in minutes and receive instant IRS

status updates.

Filing your Form 941 is easier than ever before, follow the simple steps below to

e-file Form 941 in minutes.

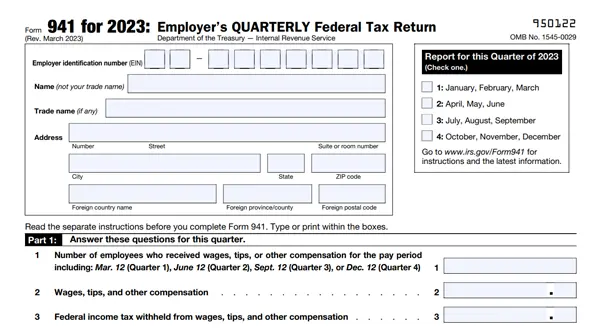

Select Form 941 and choose the quarter, then enter the necessary information.

Review the information you entered on Form 941 and edit it as needed.

E-sign the 941 Form and transmit it to the IRS. We will provide IRS status updates.

Select Form 941 and choose the quarter, then enter the necessary information.

Review the information you entered on Form 941 and edit it as needed.

E-sign the 941 Form and transmit it to the IRS. We will provide IRS status updates.

Enjoy easy and accurate 941 filing with these exclusive features:

Get real-time status updates regarding the acceptance or rejection of Forms 941 from the IRS.

An internal audit checks your return for any errors before it is transmitted to the IRS, reducing the chances of a form rejection.

The Prior-Year Filing feature allows you to e-file Form 941 tax returns with the IRS for the past three years, i.e., 2022, 2021, and 2020.

Collaborate with your team members from a single, secure account. Together you can prepare and e-file tax forms.

Eliminate manual data entry by uploading your form information in bulk using the Excel or CSV template we provide.

Apply for an IRS Signature PIN for free. In the meantime, you can easily e-sign 941 forms using Form 8453-EMP.

Form 941 is generally due to the IRS on the last day of the month following the end

of the quarter.

First Quarter

January, February, March

Second Quarter

April, May, June

Third Quarter

July, August, September

Fourth Quarter

October, November, December

If you fail to file Form 941 before the deadline might result in IRS 941 penalties. You must pay 5% of the total tax amount due. An additional 5% will be added up for each that passes without the submission of the return for up to 5 months.

It’s important to note that if you haven’t paid your tax bill in addition to the filing, you will be charged 2- 15% of the unpaid tax, determined by the number of days it remains unpaid.

Form 941 Schedule B is accompanied by Form 941, used by the semiweekly schedule depositors to report the taxability for the federal income tax withheld from the employees as well the employer’s share of social security and Medicare taxes for the period.

Form 8453-EMP is a tax form used by employers to electronically sign and submit Form 94x series, which includes Form 940, Form 941, Form 943, Form 944, and Form 945.

Form 8453-EMP serves as an electronic signature authorization for these

employment tax forms. Employers who are required to file these forms

electronically but cannot e-file directly through their software must use Form 8453-EMP to authenticate their electronic submission. It ensures the IRS that the employer is authorizing the electronic filing and agrees to be bound by it.

You can make payment through a Form 941-V payment voucher if your total tax liability for the current and previous tax year is less than $2,500 or monthly depositors who are making payments in accordance with the IRS Accuracy of Deposits Rule.

.svg)